You take out a loan and then you see these big, bold letters: APR. What does finance rate APR mean? We know the terms can be confusing. So we will try our best to spell it out for you in a manner that’s easy to follow and understand. Simply put, APR means Annual Percentage Rate or the interest rate you will have to pay for the whole year.

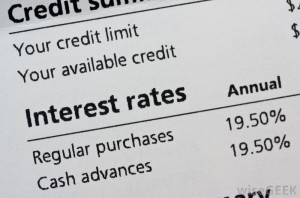

Legal Requirement

Most lending products like loans and mortgages are required by law to publish the APR. This is because the APR is a better way for loan makers to assess a potential loan. Loan makers can easily evaluate and compare different loan offerings through the APR. While most countries are strict about APRs, some do not require them to be published. Other countries have different interpretations of APRs too. For the purpose of this article, we’ll stick with the simple APR concept.

Monthly Interest Rate Vs. APR

Your monthly interest rate is the amount you pay every month together with your loan principal. The Annual Percentage Rate, however, is the rate taken by adding up the amount you have to pay per month for the whole year. Let’s look at an example to illustrate this further.

Example

Let’s say you took out a $120 loan with a 2% monthly interest rate. And this loan has to be paid back in full in twelve months. This means:

Monthly Rate for Principal: ($120/12) = $10

Monthly Interest Amount: ($120 x 0.02) = $2.4

If you add up both amounts you get $12.4 as the amount you have to pay to your creditor per month. These two figures only paint half the picture. It’s dangerous to make a loan decision on the basis of thinking that 2% or $2.4 dollars is a small amount. Yes, it’s smaller now, but wait till it adds up. By adding $2.4 monthly, this is your APR.

APR=Monthly Interest Amount x 12

Loan Amount

Which means:

APR= $2.4 x 12

$120

Which gives us:

APR=24%

Summary

It’s better to compare loan rates when you consider the APR and not just the monthly interest rate. It gives a better indication of just how much you have to pay in the long run. If you look at our example, a 2% monthly interest rate can mislead a lot of people, especially if they don’t calculate how much they will be paying if they their loan drags on. But if they see 24%, they’ll know right away the extent of the cost of their loan.

Take note though that APRs also include fees and other charges that are associated with making a loan. The best way to go about loans is to ask the creditor how the APR is computed. They will be more than happy to assist you with this request.

So get to know what an Annual Percentage Rate is, as opposed to the Monthly Interest rate. With current interest rates getting higher, it pays to be careful with the figures before committing to a loan.

Did we answer your question on what does finance rate APR mean?